Corporate Management

The Company's corporate governance system centers on the Board of Directors, Audit & Supervisory Board Members, and the Audit & Supervisory Board. Six of the 13 directors are external directors to ensure robust mutual monitoring between the directors. The nominating committee, remuneration committee, special committee and ESG committee are established voluntarily as advisory bodies to the Board of Directors. The nominating committee and remuneration committee comprise the CEO and four independent external directors (elected by a resolution of the board of directors) to ensure independence of the committees. Two of the four Audit & Supervisory Board Members are external members to ensure independent auditing functions, thereby strengthening the monitoring of management.

Skill Matrix of Board Directors and

Audit & Supervisory Board Members

(As of June 23, 2022)

| Name Title / position |

Gender*1 | Management | Finance | Legal / Risk | Digital / Technology | Sales / Marketing | Global |

|---|---|---|---|---|---|---|---|

| Ken Miyauchi (Representative Director & Chairman) |

M | ◎ | 〇 | 〇 | |||

| Junichi Miyakawa (President & CEO) |

M | 〇 | ◎ | 〇 | |||

| Jun Shimba (Representative Director & COO) |

M | 〇 | ◎ | ||||

| Yasuyuki Imai (Representative Director & COO) |

M | 〇 | ◎ | ||||

| Kazuhiko Fujihara (Board Director, Executive Vice President & CFO) |

M | 〇 | ◎ | 〇 | |||

| Masayoshi Son (Board Director, Founder) |

M | ◎ | 〇 | 〇 | |||

| Kentaro Kawabe (Board Director) |

M | ◎ | 〇 | ||||

| Atsushi Horiba (External Director) |

M | ◎ | 〇 | 〇 | |||

| Takehiro Kamigama (External Director) |

M | ◎ | 〇 | 〇 | |||

| Kazuaki Oki (External Director) |

M | ◎ | 〇 | ||||

| Kyoko Uemura (External Director) |

F | 〇 | ◎ | ||||

| Reiko Hishiyama (External Director) |

F | ◎ | |||||

| Naomi Koshi (External Director) |

F | ◎ | 〇 | ||||

| Eiji Shimagami (Full-time Audit & Supervisory Board Member) |

M | ◎ | |||||

| Yasuharu Yamada (Full-time Audit & Supervisory Board Member (External)) |

M | 〇 | ◎ | 〇 | |||

| Kazuko Kimiwada (Part-time Audit & Supervisory Board Member) |

F | ◎ | 〇 | ||||

| Yoko Kudo (Part-time Audit & Supervisory Board Member (External)) |

F | ◎ | 〇 |

- [Notes]

-

- *1Male: M, Female: F

- *This table does not show all of the skills possessed by each Board Director/Audit & Supervisory Board Member.

- *1

External Board Directors and

External Audit & Supervisory Board Members

Independent Directors/Auditors Notification (updated on June 1, 2023) (PDF: 128KB/2 pages)

Reasons of appointment

External Board Directors

| Name | Reasons of Appointment | Attendance at Board of Directors meeting in FY2021*1 |

|---|---|---|

| Atsushi Horiba | Having served as Representative Director of HORIBA, Ltd. for approximately 30 years from 1992 to date, Mr. Horiba has been leading the growth of HORIBA group and therefore has a wealth of management experience. The Company expects him to supervise the Company's management based on his knowledge and experience and give advice on the overall management of the Company. He is elected as external director so he can contribute to the Group's further growth and strengthening corporate governance. | Attended 11 out of 12 Board of Directors meetings (attendance rate of 91.7%) |

| Takehiro Kamigama | Having served as Representative Director of TDK Corporation for 12 years from 2006, Mr. Kamigama has a wealth of management experience to demonstrate leadership in enhancing profitability of TDK's business and expanding business fields. The Company expects him to supervise the Company's management based on his knowledge and experience and give advice on the overall management of the Company. He is elected as external director so he can contribute to the Group's further growth and strengthening corporate governance. | Attended 12 out of 12 Board of Directors meetings (attendance rate of 100%) |

| Kazuaki Oki | Mr. Oki has extensive knowledge and experience as a certified public accountant. The Company expects him to supervise the Company's management based on his knowledge and experience and give advice on the overall management of the Company. He is elected as external director so he can contribute to the Group's further growth and strengthening corporate governance. | Attended 12 out of 12 Board of Directors meetings (attendance rate of 100%) |

| Kyoko Uemura | Ms. Uemura has extensive knowledge and experience as a lawyer. The Company expects her to supervise the Company's management based on her knowledge and experience and give advice on the overall management of the Company. She is elected as external director so she can contribute to the Group's further growth and strengthening corporate governance. | Attended 12 out of 12 Board of Directors meetings (attendance rate of 100%) |

| Reiko Hishiyama | Ms. Hishiyama is a professor of the Faculty of Science and Engineering at Waseda University, and her research interests include management system engineering. She has a wealth of knowledge and experience in the area of cutting-edge technology such as AI and IoT. The Company expects her to supervise the Company's management based on her knowledge and experience and give advice on the overall management of the Company. She is elected as external director so she can contribute to the Group's further growth and strengthening corporate governance. | Attended 10 out of 10 Board of Directors meetings (attendance rate of 100%)*2 |

| Naomi Koshi | In addition to her extensive knowledge and experience as a lawyer in Japan and overseas, Ms. Koshi engages in a broad range of activities including municipal government initiatives and support measures for the promotion of women's career advancement. The Company expects her to supervise the Company's management based on her knowledge and experience and give advice on the overall management of the Company. She is elected as external director so she can contribute to the Group's further growth and strengthening corporate governance. | Attended 10 out of 10 Board of Directors meetings (attendance rate of 100%)*2 |

- [Notes]

-

- *1The number of Board of Directors meetings by written resolution is excluded.

- *2The attendance of Board Directors Reiko Hishiyama and Naomi Koshi shows the number of meetings held after their appointment on June 22, 2021.

- *1

External Audit & Supervisory Board Members

| Name | Reasons of Appointment | Attendance at Board of Directors meeting in FY2021*1 |

|---|---|---|

| Yasuharu Yamada | Mr. Yamada has extensive knowledge and experience relating to risk management and compliance at financial institutions as well as considerable expertise of finance and accounting. The Company designated him as an external Audit & Supervisory Board Member to leverage his knowledge and experience to perform audits from a specialist perspective and to ensure a more independent perspective in the audits. | Attended 12 out of 12 Board of Directors meetings (attendance rate of 100%) |

| Yoko Kudo | Ms. Kudo has extensive knowledge and experience in finance and accounting as a certified public accountant in the State of California. The Company designated her as an external Audit & Supervisory Board Member to leverage her knowledge and experience to perform audits from a specialist perspective and to ensure a more independent perspective in the audits. | *2 |

- [Notes]

-

- *1The number of Board of Directors meetings by written resolution is excluded.

- *2Ms. Yoko Kudo was appointed as an external Audit & Supervisory Board Member of the Company on June 23, 2022.

- *1

CEO Succession Plan

With regard to election and dismissal of Board Directors including the CEO, the Company fully respects the proposals deliberated in advance by the Nominating Committee, makes resolutions at the Board of Directors meetings, and consult the resolutions at the General Meeting of Shareholders. Board Director candidates are selected based on their qualities and abilities to contribute to the enhancement of corporate value and their deep knowledge in their respective fields of expertise. In addition, consideration is taken into account regarding the balance of skills and other factors of the Board of Directors as a whole.

Candidates to succeed the CEO are appointed as directors and executive officers, whereby future successors are developed and their suitability are overseen.

For CEO succession, after discussing the qualifications and abilities required of the next CEO, such as the ability to form a vision and knowledge of technology and finance, the nominating committee defines candidate requirements based on the strategy and selects several internal candidates. While allowing candidates to gain specific experience through actual company management and business operations, the nominating committee regularly monitors and, if necessary, reviews the requirements, processes and candidates, also taking into consideration internal 360-degree evaluations and various internal and external communications. Through this protocol, it is ensured that the most appropriate successor can be nominated for the business environment at that time.

Remuneration

The Company shall determine the remuneration of the Company's directors and audit & supervisory board members by verifying whether the amount is at a level that is highly competitive with the remuneration of the executives at the Japanese and overseas companies with largely comparable scale of business, based on the survey of domestic executive remuneration carried out by a third party organization.

The remuneration of directors shall be intended as incentive for achieving sustainable growth as well as enhancement of corporate value over the medium to long term, along with the creation of constant earnings growth, stable cash flows and sound relationship with stakeholders, while ensuring to restrain excessive risk-taking but to enhance motivation of directors to contribute to improving corporate performance not only over the short term, but also medium to long term.

The basic remuneration shall be determined by position on an annual basis, specifically at ¥96 million for the representative director & chairman, ¥120 million for the representative director, president & CEO, ¥84 million for the representative director, and ¥60 million for the board director & executive vice president, which shall be paid in cash in monthly installments. The performance-based remuneration shall consist of short-term performance-based remuneration and medium-term performance-based remuneration, which shall be paid wholly in the form of restricted stock. If any material revision or amendment occurs to the figures in the financial statements that are used as the basis for calculating performance-based remuneration, the Company may take measures such as acquiring the allotted shares without compensation, taking the job responsibility of the relevant grantee director into account.

As for external directors, who are independent from business execution, audit & supervisory board members and external audit & supervisory board members, who audit the execution of duties by directors, the policy is to pay them only basic remuneration.

- [Note]

-

- *As of June 23, 2022

- *

Total remuneration for directors and Audit & Supervisory Board Members with subtotals for each type of remuneration

and numbers of recipients (FY2021)

| Total remuneration (¥ millions) | Subtotals for each type of remuneration (¥ millions) | Number of recipients | |||

|---|---|---|---|---|---|

| Basic remuneration | Performance-based remuneration*1 | Other*2 | |||

| Directors(excluding external directors) | 2,323 | 444 | 1,606 | 273 | 6 |

| Audit & Supervisory Board Members (excluding external Audit & Supervisory Board Members) | 18 | 18 | - | - | 1 |

| External directors | 75 | 75 | - | - | 6 |

| External Audit & Supervisory Board Members | 29 | 29 | - | - | 2 |

- [Notes]

-

- *1Performance-based remuneration was granted on July 20, 2022 in the form of restricted stock remuneration, which will be accounted for (expensed) in FY2021.

- *2“Other” represents the amounts accounted for (expensed) in FY2020 concerning the stock options allotted as non-monetary payment in March 2018 and July 2021, which are different from the amounts to be gained as a result of the exercise or sale of the stock options.

- *1

Total remuneration and other compensation

paid to respective directors (FY2021)*1

| Name | Total consolidated remuneration (¥ millions) |

Title | Company name | Subtotals for each type of remuneration (¥ millions) | ||

|---|---|---|---|---|---|---|

| Basic remuneration | Performance-based remuneration | Other | ||||

| Ken Miyauchi | 539 | Director | SoftBank Corp. | 96 | 380 | 63 |

| Junichi Miyakawa | 647 | Director | SoftBank Corp. | 120 | 475 | 52 |

| Jun Shimba | 398 | Director | SoftBank Corp. | 84 | 270 | 44 |

| Yasuyuki Imai | 422 | Director | SoftBank Corp. | 84 | 294 | 44 |

| Kazuhiko Fujihara | 278 | Director | SoftBank Corp. | 60 | 187 | 31 |

| Kentaro Kawabe | 381 | Director | Z Holdings Corporation | 85 | 296*2 | - |

- [Notes]

-

- *1Only directors whose total consolidated remuneration and other compensation is ¥100 million or more.

- *2The amount is performance-based remuneration for FY2021 paid from Z Holdings Corporation and represents the total amount of bonus and share-based payment.

- *1

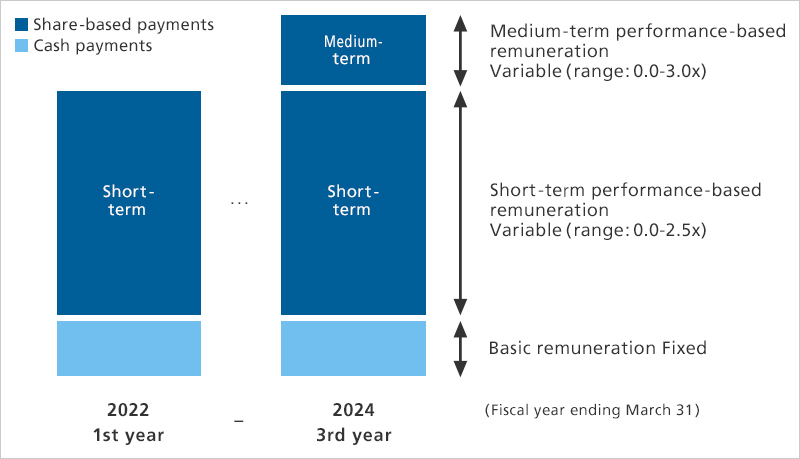

Remuneration system

for Board Directors

(excluding external directors)

Remuneration for Board Directors (excluding external directors): Consists of fixed basic remuneration and variable performance-based remuneration to provide incentives for improving the Company's short-term performance and enhancing medium- to long-term corporate value.

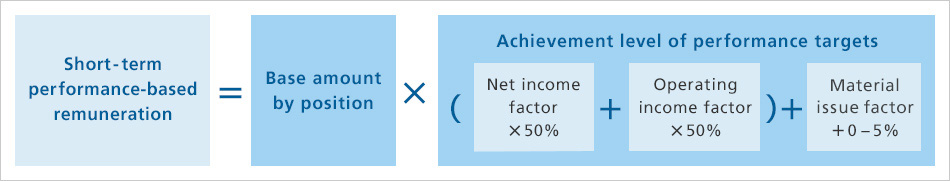

Method for calculating short-term performance-based remuneration

In principle, the composition ratio between the basic remuneration and the short-term performance-based remuneration shall be 1:2.3-3.2.

The amount of short-term performance-based remuneration shall be determined based on the Company's performance in a single fiscal year, etc., and fluctuate within the range of 0%-250% (Target: 100%) of the base amount by position.

Net income attributable to owners of the Company and operating income (both on a consolidated basis)*1 as well as ESG materiality targets*2 are adopted as indicators that determine the achievement level of the short-term performance target. The achievement level of ESG materiality targets is added separately within the range of 0-5% to the factors calculated based on the achievement level of net income and operating income targets. The short-term performance-based remuneration shall be paid in full in the form of restricted stock.

- [Notes]

-

- *1In adopting net income attributable to owners of the Company and operating income as indicators, the factors shall be determined after consultation with the Remuneration Committee if there are particular factors that should be taken into consideration such as special circumstances including impairment loss, major changes in other management indicators (including FCF), and material scandals or accidents.

- *2Materiality targets are those adopted from among the six material issues identified for the sustainable growth of the Company. Targets include the ratio of renewable energy used for the power by base stations as a measure to achieve carbon neutrality by 2030.

- *1

Method for calculating medium-term performance-based remuneration

In principle, the composition ratio between the basic remuneration and the medium-term performance-based remuneration shall be 1:1.7-2.1.

The amount of medium-term performance-based remuneration shall be determined based on the Company's performance over a three-year term.

Total Shareholder Return (TSR) is adopted as an indicator to determine the achievement level of the medium-term performance target. The medium-term performance-based portion fluctuates within the range of 0-3.0, depending on the index, and its factor is calculated based on comparison between TSR performance of the Company and that of TOPIX. The medium-term performance-based remuneration shall be paid in full in the form of restricted stock.

- [Note]

-

- *In adopting TSR, the factor shall be determined after consultation with the Remuneration Committee if there are special circumstances such as share split and special factors that should be taken into consideration such as material scandal or accidents.

- *